Brains and Stock Markets Follow the Same Rules When Crises Hit, Study Finds

A new study from researchers at the University of Michigan has found that our brains and stock markets behave in surprisingly similar ways when facing a crisis. At first, that might sound like a strange comparison — one is biological and the other financial — but both are complex systems that rely on balance and stability to function properly. When that balance is disturbed, both can collapse and recover in strikingly similar patterns.

The research, led by UnCheol Lee, Ph.D., from the Department of Anesthesiology at the University of Michigan, and senior author George Mashour, M.D., Ph.D., director of the university’s Center for Consciousness Science, was published in the journal Proceedings of the National Academy of Sciences (PNAS). Their paper is titled “Proximity to Explosive Synchronization Determines Network Collapse and Recovery Trajectories in Neural and Economic Crises.”

The Core Idea: Finding Common Ground Between Brains and Markets

Both the brain and the stock market operate near a state scientists call criticality — a delicate balance between order and chaos where systems are most flexible, efficient, and adaptive. When something disrupts that balance, the system can suddenly tip into a crisis, losing its stability.

In physics, these changes are known as phase transitions. They can happen in two main ways:

- First-order transitions are abrupt and explosive, like water suddenly freezing into ice.

- Second-order transitions are gradual and more stable, like a magnet slowly losing its magnetism as it heats up.

The Michigan team discovered that both the human brain under anesthesia and the stock market during an economic crash experience these same types of transitions. In other words, both systems can shift between smooth and explosive changes depending on their internal structure and resilience.

How the Study Began

The idea for the study emerged when Lee observed that some patients recover from anesthesia faster than others. Anesthesia temporarily disrupts the brain’s communication network — essentially introducing a controlled “crisis.” Lee began wondering if the brain’s recovery from anesthesia might resemble how an economy recovers from a financial crash.

This led the team to ask: could there be a fundamental rule that predicts how complex systems like brains or stock markets collapse and recover? And could that rule be expressed using the universal language of physics?

Modeling Collapse and Recovery

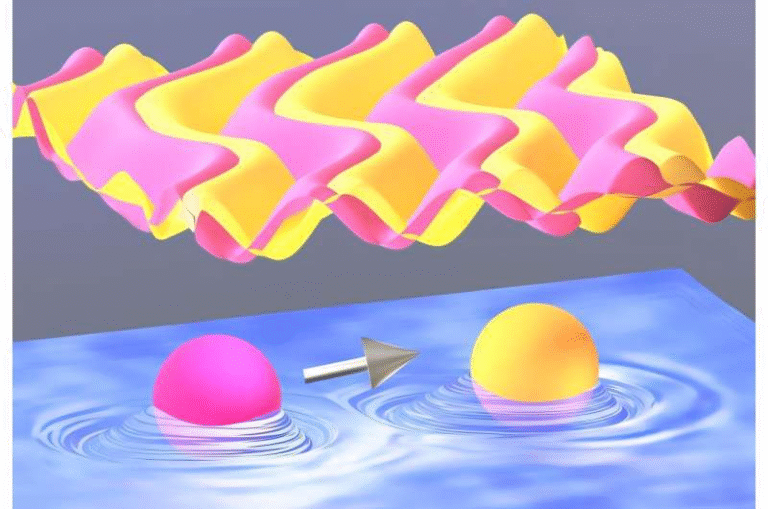

To answer that, the researchers built a computational network model inspired by the physics of synchronization. They simulated different types of networks to see how they behave under stress. The key metric they used was something they called “Explosive Synchronization (ES) proximity.”

In simple terms, ES proximity measures how close a system is to undergoing a sudden, explosive transition rather than a gradual one. Systems that are closer to this explosive state tend to collapse faster when stressed and take longer to recover afterward.

Using the model, the team generated artificial data to study how a network’s internal characteristics predict its behavior during collapse and recovery. They found that networks closer to the first-order transition type were far less stable. These systems showed larger fluctuations in synchronization — meaning their internal activity became much more erratic right before collapse.

Testing the Model: Brains Under Anesthesia

To test their theory in the real world, the researchers turned to EEG (electroencephalogram) recordings from 16 patients undergoing anesthesia.

They found that the brain’s proximity to the explosive synchronization threshold predicted how fast or slow a person lost and regained consciousness. In other words, the closer the brain was to the explosive state, the faster the patient went under and the slower they woke up.

This insight could be particularly valuable for personalized anesthesia — allowing doctors to predict how individual brains respond to anesthetic drugs and adjust doses accordingly. It could even improve safety during surgeries, especially for vulnerable patients.

Applying the Same Model to the Stock Market

The researchers then applied their network model to the global financial crisis of 2007–2009. They analyzed stock-market data from 39 countries, representing around 100 major companies per country, to see how markets behaved during collapse and recovery.

Just like with the brain, markets with a higher ES proximity — meaning they were closer to the explosive regime — experienced faster collapses and slower recoveries.

Interestingly, these “fragile” markets tended to be emerging economies with lower GDP per capita, suggesting that wealthier countries may have more resilient financial networks that recover more smoothly from crises.

This finding implies that economic stability isn’t just about policies or capital — it’s also about the structure and dynamics of the financial network itself.

Why This Matters

The implications of this study go beyond medicine and finance. If we can identify the conditions that make networks — biological, economic, or even environmental — prone to collapse, we can design strategies to make them more resilient.

In medicine, understanding a patient’s brain network could help tailor anesthesia plans, reduce recovery time, and improve outcomes. In economics, it could help governments and financial institutions anticipate market crashes and plan recovery strategies before chaos hits.

The idea could also apply to other global systems, such as climate networks, power grids, or social media ecosystems, where a small disturbance can trigger widespread effects.

Essentially, the study offers a unifying framework for understanding how complex systems — no matter their domain — behave when pushed to the edge.

The Science Behind It: Phase Transitions and Explosive Synchronization

To appreciate the study’s novelty, it helps to understand a bit about the physics behind it.

- Phase transitions describe how a system changes its state — like ice melting into water.

- In networks, these transitions correspond to how nodes (like brain cells or companies) start synchronizing their behavior.

- Explosive Synchronization (ES) is a special kind of first-order transition where synchronization happens suddenly rather than gradually. It’s called “explosive” because the shift from disorder to order occurs almost instantaneously.

In the brain, ES can manifest as an abrupt change in neural activity — such as losing consciousness. In markets, ES can appear as a sudden crash when investor sentiment shifts rapidly.

The researchers quantified ES proximity by examining variations in network synchronization near the tipping point. Higher variance meant a system was close to the explosive regime, signaling greater instability.

Limitations and What Comes Next

While the study’s findings are exciting, they come with some caveats. The EEG sample size was relatively small, and the financial data focused only on one major global crisis. More studies across different types of crises — like pandemics or supply-chain disruptions — would help test whether the findings hold universally.

Another challenge is measuring ES proximity in real-world systems. It requires high-quality, continuous data and advanced computational modeling, which may not always be available.

Still, the research opens up fascinating possibilities. If scientists and policymakers can routinely measure how close a system is to an explosive transition, they might intervene early — before collapse occurs.

For example, anesthesiologists could adjust drug doses to prevent delayed recovery, while economists could identify signs of market fragility before investors panic.

Broader Applications Across Fields

The beauty of this work lies in its universality. Complex systems — whether they’re composed of neurons, companies, or even climate elements — share mathematical patterns in how they behave under pressure.

This insight suggests that network science could become a powerful predictive tool across disciplines. By understanding the structure and synchronization patterns of any network, researchers may one day forecast and prevent crises — from financial meltdowns to power outages or even ecological tipping points.

In short, this research bridges the gap between neuroscience, economics, and physics, showing that seemingly unrelated systems are governed by the same fundamental principles.

Research Reference:

Lee, U., Kim, H., Kim, M., Oh, G., Joo, P., Park, A., Pal, D., Tracey, I., Warnaby, C. E., Sleigh, J., & Mashour, G. A. (2025). Proximity to Explosive Synchronization Determines Network Collapse and Recovery Trajectories in Neural and Economic Crises. Proceedings of the National Academy of Sciences (PNAS). https://doi.org/10.1073/pnas.2505434122