Investors Are Shifting Toward Positive ESG Screening as Research Reveals Changing Preferences

Investors around the world are rethinking how they approach environmental, social, and governance (ESG) investing, and new academic research suggests a clear shift is underway. Instead of focusing mainly on excluding companies that fail certain ethical tests, many investors are now gravitating toward positive ESG screening, a strategy that actively favors companies with strong ESG performance. According to a recent study led by researchers at Florida Atlantic University, this preference becomes even stronger during periods of stock market uncertainty.

The research highlights an important evolution in sustainable investing—one that reflects not only changing values, but also changing views on risk management, diversification, and long-term financial performance.

What the Study Examined and Who Conducted It

The study, titled “Positive versus negative ESG portfolio screening and investors’ preferences,” was published in The European Journal of Finance in 2025. It was authored by Anna Agapova, professor of finance at Florida Atlantic University’s College of Business, along with Uliana Filatova, assistant professor of finance at Grand Valley State University, and Ivan Yuk, a first-year undergraduate finance student at the University of Florida’s Warrington College of Business.

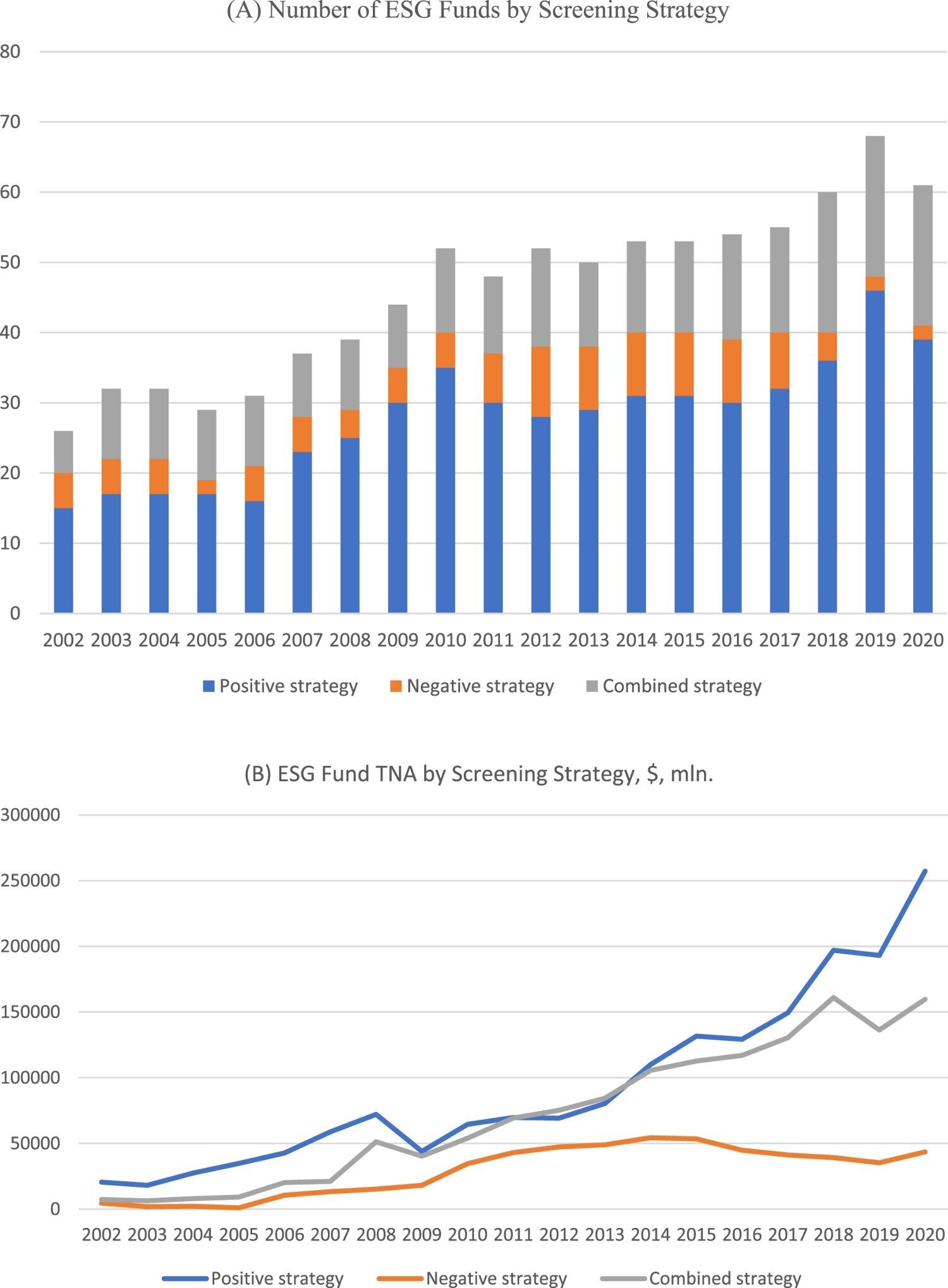

Using data on ESG mutual funds, fund flows, and total net assets (TNA), the researchers examined how investors allocate capital across funds that use different ESG screening strategies. They paid particular attention to how investor behavior changes during periods of market stress and heightened volatility.

Understanding Positive vs. Negative ESG Screening

To understand why this shift matters, it helps to clarify the difference between the two main ESG screening approaches.

Negative ESG screening is the more traditional method. It excludes companies or entire industries based on specific criteria, such as involvement in tobacco, gambling, weapons, fossil fuels, or other so-called “sin stocks.” This approach has historically been popular because it is simple, transparent, and easier to justify from a legal and compliance standpoint.

Positive ESG screening, on the other hand, takes a more proactive approach. Instead of focusing on exclusions, it deliberately builds portfolios around companies with high ESG scores, strong sustainability practices, and better governance structures. Rather than asking “What should we avoid?”, positive screening asks “Which companies are doing this best?”

The study found that while negative screening remains common, investors are increasingly drawn to the broader and more inclusive nature of positive screening.

Why Investors Are Leaning Toward Positive Screening

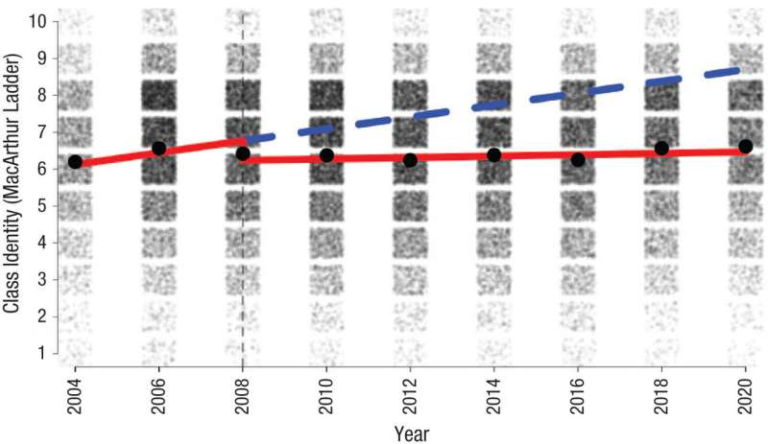

One of the most important findings of the research is that both retail and institutional investors show a clear preference for positive ESG screening. This preference is visible in how capital is allocated: funds that rely on positive screening attract a larger share of total investment flows, particularly during uncertain or declining market conditions.

The reasoning behind this shift is largely financial rather than purely ethical. Positive screening allows portfolios to remain more diversified, since fewer sectors and companies are excluded outright. Greater diversification, in turn, helps reduce overall portfolio risk.

The researchers note that companies with strong ESG scores often have lower downside risk exposure. These firms may be better prepared to manage environmental threats like flooding or property damage, social risks such as labor disputes, and governance-related failures that can lead to scandals or regulatory penalties. As a result, ESG-focused portfolios tend to be less volatile and more resilient during financial downturns.

Institutional vs. Retail Investor Behavior

While both groups favor positive ESG screening, the study found some differences between institutional and retail investors.

Institutional investors, such as pension funds and asset managers, tend to show a stronger preference for positive screening. This may reflect their greater sophistication, access to ESG data, and ability to manage complex portfolio strategies. Institutional investors are also more likely to prioritize long-term risk mitigation over short-term simplicity.

Retail investors, meanwhile, also allocate heavily to positive ESG-screened mutual funds, especially as ESG awareness grows. For many individuals, positive screening aligns well with personal values while still offering a compelling financial case.

Interestingly, surveys of fund managers revealed that even those who continue to use negative screening often acknowledge that it can hurt financial performance by limiting diversification. Despite legal and operational advantages, negative screening may not fully align with what investors actually want.

Performance, Risk, and Market Downturns

Another key takeaway from the study is how ESG-screened investments behave during market stress. Funds that emphasize positive ESG screening tend to perform better on a risk-adjusted basis, particularly during financial downturns.

The researchers found that ESG-focused portfolios are generally less volatile and experience smaller drawdowns during bear markets. While raw returns may not always significantly outperform other strategies, investors appear to value the stability and downside protection these portfolios offer.

This helps explain why positive ESG funds attract higher capital inflows during periods of uncertainty. Investors are not just chasing returns; they are actively seeking strategies that help preserve capital when markets turn rough.

Why Fund Managers Are Paying Attention

For fund managers, the findings carry practical implications. Although negative screening may still be easier to implement and defend legally, it does not fully reflect investor preferences. Positive screening, while more complex, aligns more closely with investor goals related to diversification, risk control, and sustainability.

The study suggests that fund managers who want to remain competitive should consider evolving their ESG strategies. Offering more products built around positive screening could help attract and retain investors who are increasingly conscious of both financial resilience and ESG performance.

A Broader Look at ESG Investing

Beyond this specific study, the shift toward positive ESG screening fits into a larger trend within sustainable finance. ESG investing has moved well beyond simple exclusions and ethical branding. Today, it increasingly focuses on financial materiality, asking how environmental, social, and governance factors directly affect long-term business performance.

Positive screening overlaps with other approaches such as ESG integration, where ESG factors are systematically incorporated into traditional financial analysis, and best-in-class investing, which selects top performers within each industry rather than excluding entire sectors.

As ESG data improves and becomes more standardized, investors are better equipped to identify companies that manage risks effectively and adapt to long-term structural challenges like climate change and regulatory shifts.

What This Shift Means Going Forward

The growing preference for positive ESG screening suggests that sustainable investing is becoming more strategic and data-driven. Investors are no longer satisfied with simply avoiding controversial industries. Instead, they want portfolios that actively support companies demonstrating leadership in sustainability, governance, and risk management.

This shift also challenges the idea that ESG investing requires sacrificing financial performance. According to the research, positive ESG screening can offer a compelling balance between values and financial discipline, especially when markets are unstable.

As uncertainty continues to shape global financial markets, it is likely that interest in positive ESG strategies will only grow.

Research paper reference:

https://doi.org/10.1080/1351847X.2025.2585967