Regular Email Reminders Can Gently Push Bank Customers to Save More Money

Saving money is something most people want to do, yet many struggle to make it a consistent habit. A large new study suggests that something as simple as a regular email reminder from a bank can make a measurable difference. The research shows that thoughtfully designed reminder emails can nudge customers to move money into savings accounts more often, even if the effect on each individual is relatively small.

The study was led by Katherine L. Milkman, a professor at the Wharton School of the University of Pennsylvania and co-director of the Behavior Change for Good Initiative (BCFG). Along with a large team of collaborators, Milkman set out to answer a basic but important question: can behaviorally informed email reminders actually help people save more money in the real world?

Why saving is such a persistent problem

The motivation for the research is rooted in a troubling financial reality. A significant share of adults in the United States have little or no financial cushion. Roughly one in four adults has no savings at all, and about four in ten have less than one month’s income set aside. This leaves millions of people vulnerable to unexpected expenses such as medical bills, car repairs, or job interruptions. When emergencies hit, many are forced to rely on high-interest debt or sell personal belongings just to get by.

Behavioral scientists have long argued that the problem is not simply a lack of willpower or financial knowledge. Instead, everyday distractions, forgetfulness, and procrastination play a huge role. Moving money from a checking account to a savings account often falls into the category of “important but not urgent,” making it easy to delay repeatedly.

One of the largest savings experiments ever conducted

To test whether reminders could help overcome this problem, the research team ran what is described as a megastudy, involving nearly two million bank customers in the United States. The scale of the experiment makes it one of the largest field studies ever conducted on personal savings behavior.

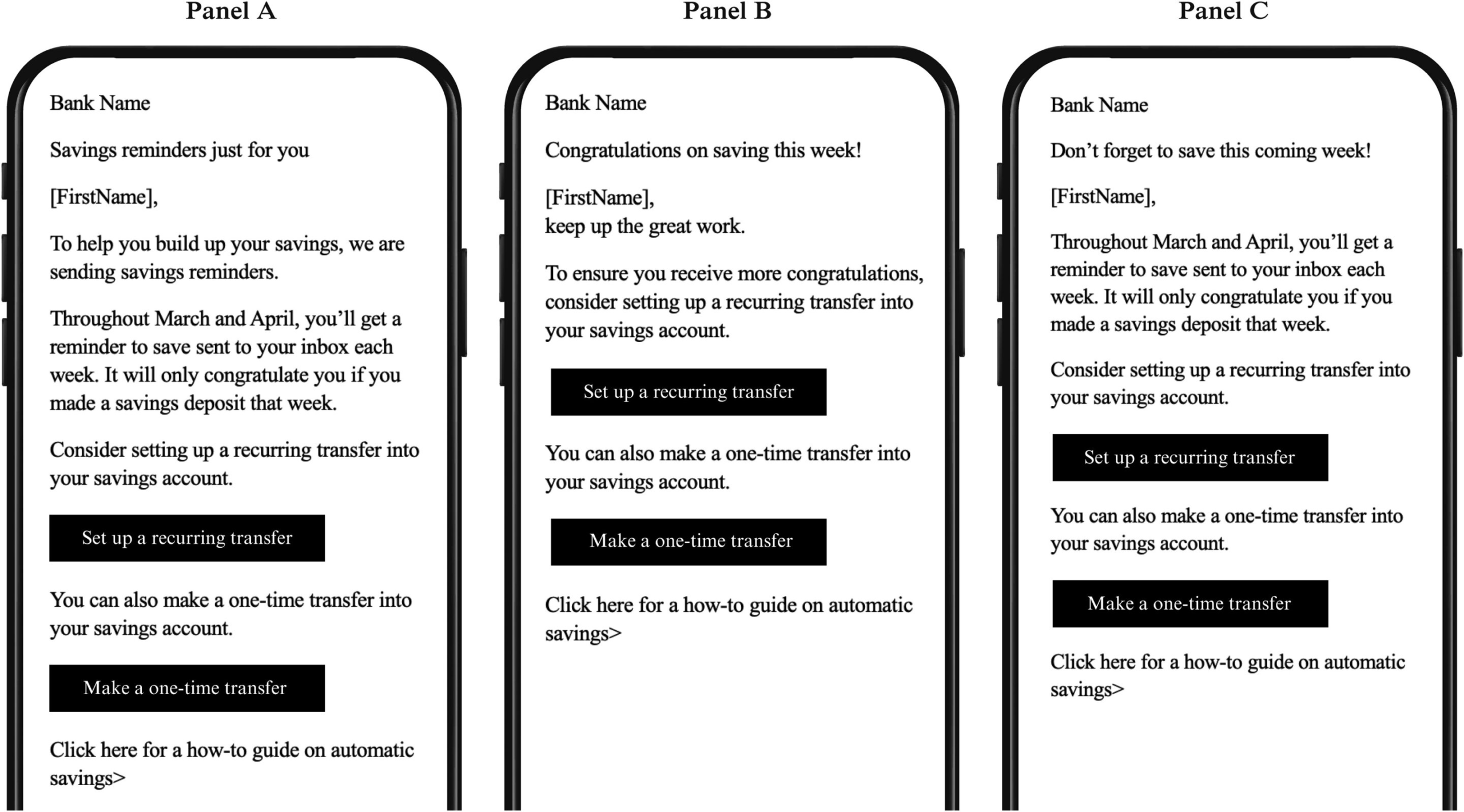

Participants were randomly divided into groups. Some customers received no emails at all and served as a control group. Others received one of seven different email campaigns designed to encourage saving. These campaigns ran over a two-month period and varied in timing, frequency, and message content.

Some emails were sent at the start of the month, when people might be planning their finances. Others were triggered after customers received a large deposit of $300 or more, suggesting they might have extra funds available. Another set of emails arrived near the end of the month, encouraging people to save whatever money they had left. There were also messages designed to congratulate customers after they made a savings deposit, reinforcing positive behavior.

The overall impact of reminder emails

When the researchers looked at the results across all campaigns, they found that any reminder email was better than none. Customers who received emails were slightly more likely to make a one-time transfer into their savings account during a given month.

Specifically, receiving emails increased the likelihood of making a monthly savings deposit by about 0.05 percentage points, which translates to roughly a half-percent increase compared to customers who received no messages. While this may sound small, the researchers emphasize that even modest effects can add up when applied across millions of people.

The email strategy that worked best

Not all reminder emails were equally effective. One approach clearly stood out from the rest: weekly, behavior-based emails.

These messages were tailored based on what a customer had done in the previous week. If a person had not made a savings deposit, they received a gentle nudge encouraging them to transfer money into savings. If they had already saved, they received a congratulatory message acknowledging their progress.

This combination of reminders and positive reinforcement proved to be the most effective strategy tested. Customers receiving these weekly, tailored emails were about 1.3% more likely to make a one-time savings deposit in a given month compared with those who received no emails. It was the strongest result among all seven email campaigns and also one of the most frequent.

The finding reinforces a core insight from behavioral science: keeping a goal top of mind and responding to people’s recent behavior can meaningfully influence what they do next.

Small nudges, big collective impact

Although the impact on any single person was modest, the potential collective effect is much larger. The researchers estimated that if the most effective two-month email campaign had been sent to every participant in the study, it could have generated an additional $6 million to $10 million in savings overall.

Importantly, the cost of sending these emails was close to zero for the bank. From an institutional perspective, this makes reminder campaigns an extremely cost-effective intervention, especially when compared with more expensive incentive-based programs.

Where the emails fell short

The study also revealed clear limits to what reminder emails can achieve on their own. While emails increased one-time transfers into savings accounts, they did not increase the number of customers who set up recurring automatic transfers.

The researchers believe this result is closely tied to friction in the bank’s digital systems. At the time of the study, the bank’s mobile app did not support setting up recurring transfers easily. Even if customers were motivated by the emails, the process of following through was cumbersome or unavailable.

This finding highlights a key principle in behavior change research: motivation is not enough. If systems are poorly designed or inconvenient, even well-timed nudges may fail to produce lasting habits.

Why friction matters in financial behavior

Friction refers to small obstacles that make an action harder than it needs to be. In the context of saving money, friction can include confusing interfaces, too many steps, or limited functionality in banking apps. Behavioral research consistently shows that reducing friction often has a bigger impact than increasing motivation alone.

The researchers suggest that if customers had been able to set up recurring transfers directly from the email or app, the effects of the reminders might have been significantly larger and longer-lasting.

What this means for banks and policymakers

The findings have clear implications for banks, policymakers, and financial technology designers. Banks already play an active role in shaping customer behavior through default settings, notifications, and app design. This study suggests that simple, well-designed reminder emails can be part of a broader strategy to help customers build financial resilience.

From a policy perspective, the researchers point out that governments already encourage saving through measures like tax advantages and retirement plan defaults. Similar incentives could be explored for banks that adopt proven, low-cost strategies to support everyday saving behavior.

Why email was just the beginning

Email was chosen for this study because it was the easiest communication channel to test at scale. However, it is also easy for people to ignore. The researchers note that future studies could explore longer campaigns, different communication channels, or combinations of reminders and automatic features to see whether stronger and more durable effects can be achieved.

The broader lesson is that even small behavioral nudges, when thoughtfully designed and widely applied, can move the needle on persistent financial challenges.

A practical takeaway for everyday savers

For individuals, the study serves as a reminder that saving often fails not because of bad intentions, but because of forgetfulness and delay. Simple cues, whether from a bank or self-created reminders, can help turn saving from an afterthought into a routine action.

As this massive experiment shows, sometimes the difference between not saving and saving is just a well-timed reminder.

Research paper:

Milkman, K. L. et al. Can reminder emails compel Americans to save? A two-million-person megastudy. PNAS Nexus (2025). https://academic.oup.com/pnasnexus/article/4/9/pgaf280/8244974